What is a Self-Directed IRA?

A self-directed individual retirement account (IRA) is like any other IRA you may be familiar with. The term “self-directed” refers to the fact that you’re in the driver’s seat. Rather than relying solely on fund managers or financial advisors, you can make you own investment decisions, conduct due diligence, and choose assets you believe will perform well. This level of control is appealing to those who want a hands-on approach to their retirement saving.

With a self-directed IRA, your investment options are expanded to include alternatives to the traditional stock and mutual fund investments many accounts are limited to. Instead of naming what you can invest in, the IRS only lists a handful of items that are not permitted in an IRA. Aside from that list, the sky’s the limit – provided you follow IRS guidelines for the account.

Why don’t more IRA companies offer self-directed IRAs or other self-directed accounts?

This type of account can only be held by qualified custodians who are equipped to handle the unique recordkeeping requirements that come with this type of account, due to the guidelines governing retirement accounts.

to learn more about what makes a self-directed IRA different, and see if the account makes sense for you.

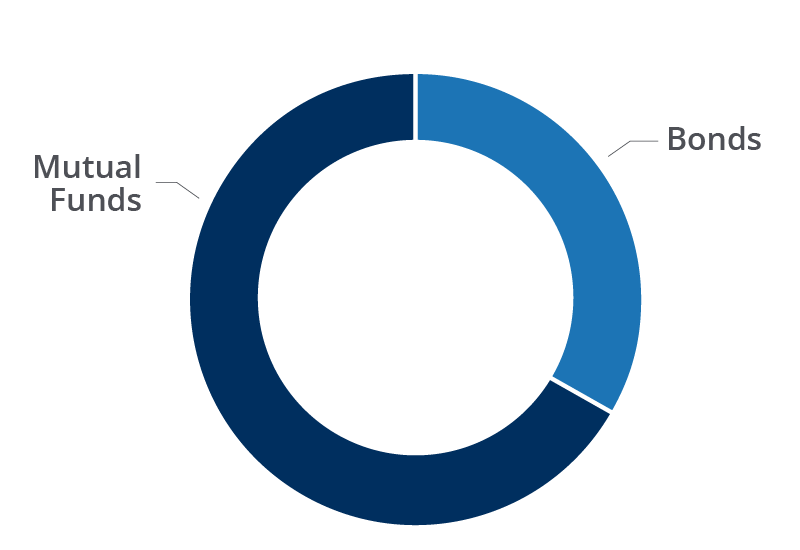

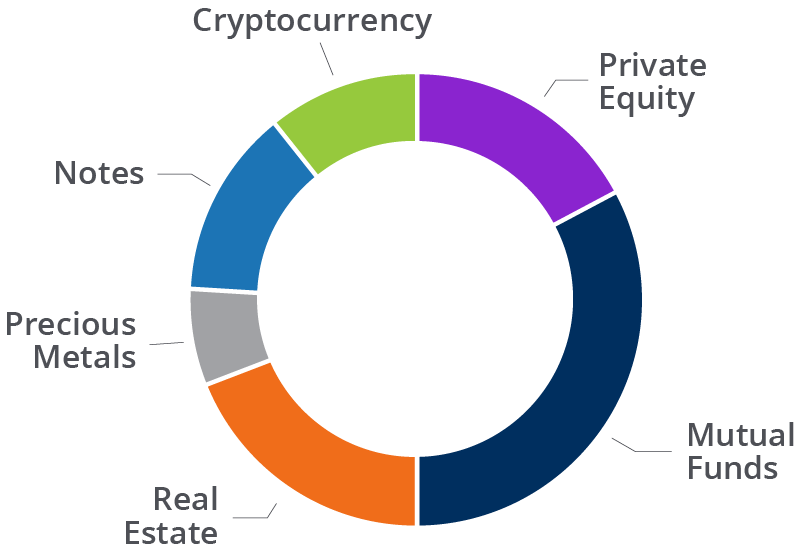

Self-directed IRA vs "Conventional" IRA Portfolio Examples

A retirement account with traditional investments vs. the possibilities of a self-directed retirement account.

As a directed custodian, Equity Trust does not endorse, recommend, or opine on suitability of any specific asset class or investment.

Still want traditional investments as part of your diversified portfolio? At Equity Trust you can hold these and your alternative investments in one account. Our affiliated company, ETC Brokerage Services, makes it easy.

Video Resources

Advantages of a Self-Directed IRA

Greater Control and Flexibility

Tired of leaving your entire life savings at the mercy of the unpredictable stock market? Self-directed accounts enable you to choose your own investments, which allow you to invest in assets you know, understand, and may even be able to see. Your retirement account is no longer beholden to world events that could change your livelihood in an instant.

More Investment Options

With a self-directed IRA, your investment options are nearly endless, giving you the option to truly diversify into an array of alternatives to traditional assets. Clients have invested their retirement accounts into real estate, private equity, notes, precious metals, cryptocurrency, and more.

Potential for Higher Returns

Diversifying your retirement account could enable you to reach your financial goals faster than if you limited it to traditional investments. Several alternative asset classes have outperformed the S&P 500 over the past 20 years.1 Alternative investments have also been increasing in popularity among the ultra-wealthy and institutional endowments.2

Tax Benefits

Sick of paying taxes on your investments? An Equity Trust self-directed account provides you with the opportunity for tax-free or tax-deferred profits.

Estate Planning Benefits

Certain self-directed accounts allow the beneficiaries to receive the account’s assets after the account owner’s passing with little to no tax. You can leave a legacy for those you love and care about.

Impact of taxes on your savings over time

Saving in a taxable account vs. Traditional and Roth IRAs. Hypothetical 8-percent return over 25 years.

Interested in alternative investments but don’t know where to start?

No problem. We make it easy to locate potential investments.

Available through our online account management system, myEQUITY, the WealthBridge portal provides a secure, direct connection to alternative asset investment platforms.

Discover WealthbridgeOur online marketplace introduces you to dozens of asset providers across various investment types including turnkey real estate, private equity, cryptocurrency, precious metals, and more.

Visit Investment DistrictChoosing a Self-Directed IRA Custodian

To open an IRA that is truly self-directed, you need to work with a custodian that is qualified to handle this type of account. IRA companies such as Fidelity, Schwab, and other large brokerages may claim to be “self-directed” because you can choose your own stocks, but they’re not a true self-directed IRA custodian because you can’t invest beyond traditional investments.

Difference between self-directed account custodians and typical IRA custodians

IRA Custodian / Brokerage

| Can hold publicly traded investments |

Self-Directed IRA Custodian

| Can hold publicly traded investments | |

| Can hold alternative investments | |

| You are responsible for choosing investments, doing due diligence, and directing the custodian to fund the investment |

Self-directed investing has been an exclusive club, with only about 3% of Americans investing in alternative investments in an IRA. But that number has been growing as more people discover and harness the power of self-directed investing.

NOT ALL IRA COMPANIES ARE EQUAL

While there are several IRA companies that will enable you to open a self-directed IRA, they don’t all face the same level of regulatory scrutiny and don’t offer the same value.

Learn more about the difference between the types of IRA companies.

CHARACTERSTICS OF A TOP CUSTODIAN

Here are things to keep in mind as you evaluate potential custodians. Ask the IRA company about each of these aspects:

Investment Options: Does the custodian enable you to hold a broad range of assets in your portfolio?

Regulation: Is the company regulated by a state or federal entity?

Years in Business: Does the company have a track record of being there for it’s clients?

Client Support: Will someone answer the phone if you call the company with a question?

Fees: Are the fees fair for what’s provided? Does the company charge by account value or flat fee? Does the company charge for each transaction?

Investor Education: Are you able to find resources to help you understand some of the more complex aspects of self-directed investing?

Reviews or Testimonials: Don’t just take it from the company – see if you can find reviews from actual clients.

Facilitator, Administrator, Custodian: What's the Difference?

| Facilitator | Administrator | Custodian | |

|---|---|---|---|

| Must meet IRS requirements | |||

| Has the authority to hold assets, investments, or property, and to issue funds (write checks, issue wires, etc.) | |||

| Will open and administer your account | |||

| Must take extra steps to move your funds to and from a custodian to complete transactions | Sometimes |

Facilitator, Administrator, Custodian: What's the Difference?

| Must meet IRS requirements | |

| Has the authority to hold assets, investments, or property, and to issue funds (write checks, issue wires, etc.) | |

| Will open and administer your account | |

| Must take extra steps to move your funds to and from a custodian to complete transactions |

| Must meet IRS requirements | |

| Has the authority to hold assets, investments, or property, and to issue funds (write checks, issue wires, etc.) | |

| Will open and administer your account | |

| Must take extra steps to move your funds to and from a custodian to complete transactions | Sometimes |

| Must meet IRS requirements | |

| Has the authority to hold assets, investments, or property, and to issue funds (write checks, issue wires, etc.) | |

| Will open and administer your account | |

| Must take extra steps to move your funds to and from a custodian to complete transactions |

Have you heard about Checkbook IRA custodians and wondered what they’re all about? Here’s what you should know about this type of provider.

EQUITY TRUST: A LEADING SELF-DIRECTED IRA CUSTODIAN

Don’t entrust just any IRA custodian with your financial future. Named Best Overall Self-Directed IRA Company from 2020-2023 by Investopedia, Equity Trust is your best choice:

Nearly limitless investments, one account

Traditional financial institutions limit your IRA to traditional investments. With Equity Trust, you can truly diversify into a range of options including real estate, private entities, cryptocurrency, precious metals, and more, in addition to stocks, bonds, and mutual funds — all in one account.

The power to help you succeed

Our size, expertise, and technology help us ensure that we’re there when you need us most. With over 400 associates focused on processing more than 1.2 million transactions each year, we work diligently to enhance your experience.

Your direction, our support

Our knowledgeable, client-focused associates are here to provide dedicated, personalized service, from opening your account to assisting you with investment transactions. You can lean on our 50 years of experience in the financial services industry.

Talk to a knowledgeable IRA Counselor.

Access to opportunities to match your goals

Don’t have an investment in mind? Most custodians establish your account and leave you on your own to figure it out. Our Investment District online marketplace enables you to find potential investment opportunities with the click of a button, and our WealthBridge portal connects your account instantly to integrated investment providers for fast, easy investing.

Common Misconceptions About Self-Directed IRAs

Some investors are too intimidated by self-directed IRAs to get started. Knowing how the account works and what to expect can ease a lot of hesitation.

COMPLEXITY

Misconception: Self-directed IRAs may involve more paperwork and steps than investing outside of an IRA.

Truth: The right IRA custodian can help make this process easier. Custodians like Equity Trust can guide you through each step of the process, from account onboarding to investment liaisons. Set up a call with an IRA Counselor to start now.

RISK

Misconception: When you’re in charge of finding your own investments, it’s hard to know where to go to find resources to help combat fraud.

Truth: It’s important to conduct due diligence on any potential investment for your IRA. If you don’t know where to start, there are trustworthy resources that can guide you through the exploration process. See the Fraud Awareness Resource Center.

LACK OF LIQUIDITY

Misconception: If all of my retirement funds are tied up in an investment such as real estate or precious metals, I will have no cash to withdraw as retirement income.

Truth: There are several ways to ensure you have the income you need or are required to withdraw. If you have multiple retirement accounts, your required minimum distribution can be taken from any account. So if you have another retirement account with a more liquid asset, you can take your required withdrawal from there. You could also sell a portion of your investment for more liquidity.

HIGH FEES

Misconception: I’d pay much more in fees with a self-directed IRA than I would with an IRA or 401(k) at a traditional brokerage.

Truth: Most people don’t realize just how much they’re paying for their retirement account. If you look closely at your statements, you may discover fees are eating away at your account balance. With a self-directed IRA custodian, your fees cover the unique record keeping that’s required for holding alternative investments in a retirement account, as well as other services.

Understand what you’re paying for with your self-directed IRA custodian and make sure the fee structure works for what you plan to do.

NOT ENOUGH MONEY

Misconception: Many investors believe they need a large balance in their retirement account to be able to invest in alternatives such as real estate.

Truth: There are several ways to have smaller IRAs work for investors. For example, you can partner your IRA funds with other IRA or non-IRA funds to make a purchase. Many investors also start out with small-dollar investments, such as loaning money, and build up their account until they have enough for a larger investment.

Learn more about partnering multiple accounts to bolster your buying power.

Self-Directed IRA Rules

Before you get started, make sure you know the IRA rules so you don’t risk getting a penalty or losing the tax-advantaged status of your account.

RULES TO KNOW

Prohibited Transactions: The IRS defines a prohibited transaction as: “any improper use of your IRA account or annuity by you, your beneficiary, or any disqualified person.”

Disqualified Persons: Your IRA cannot transact with certain people including “your fiduciary and members of your family (spouse, ancestor, lineal descendant, and any spouse of lineal descendant),” according to the IRS.

Indirect Benefits: The purpose of the IRA is to provide for your retirement in the future. It is considered an “indirect benefit” if your IRA is engaged in transactions that, in some way, can benefit you personally today.

Permitted Investments: The IRS does not provide guidance on what is permitted, but dictates only what is NOT permitted. Examples of prohibited IRA investments include collectibles (such as artwork, stamps, rugs, antiques, and gems), certain coins, and life insurance. See IRS Publication 590 for more information about prohibited investments.

UBIT (Unrelated Business Income Tax): If your IRA owns interest in an asset that produces unrelated business taxable income (UBTI), your IRA may be subject to an unrelated business income tax (UBIT) pursuant to Section 511 of the Internal Revenue Code.

Contribution and Withdrawal Rules: Retirement accounts have maximum contribution amounts for each year. Accounts also have a minimum age at which you can withdraw funds, and some require you to withdraw funds after you reach a certain age.

Getting Started with a Self-Directed IRA

Account Types

The following account types may be self-directed when you open the account through Equity Trust. The type of account to consider depends on your goals and whether you qualify. Click on each for more information, including potential benefits and eligibility requirements for each type of account.

Individual Accounts

Business Owner/Employee Accounts

Other Types of Accounts

How to set up a self-directed account

Here are the three steps to getting started with an Equity Trust self-directed IRA or other account:

Open your Equity Trust account

One of our specialized counselors will walk you through the process, or you can do it online with myEQUITY.

Fund your new tax-advantaged account

You can fund your account via rollover, transfer, or out-of-pocket contribution.

Select your investment and direct Equity Trust to fund it

myEQUITY investment wizards walk you through the investment process online at your convenience. Our liaisons are ready to help if you need it.

FUNDING OPTIONS

There are three main ways to fund a self-directed account:

Rollover: A distribution from an existing account, such as a 401(k), 403(b), 457, Thrift Savings Plan, which is then redeposited, or “rolled over” into a like-tax-environment account.

Transfer: Moving an account, such as an IRA, from one financial institution to another. Transferring funds from one custodian to another is a nontaxable event – provided the account types are the same tax environment. Learn more about the difference between rollovers and transfers.

Roth Conversion: Roth IRAs may be funded through a Roth conversion, which involves converting funds and/or assets from a tax-deferred account (such as a Traditional IRA, SEP IRA, SIMPLE IRA, 401(k) or other tax-deferred plan) to a Roth IRA.

A Roth conversion is a taxable event: When you convert from a tax-deferred account to an after-tax Roth IRA, the amount of the conversion is added to your ordinary income in the year of the conversion and subject to ordinary income tax. It’s important to consult with a CPA, tax attorney, or other financial professional when considering a Roth conversion.

Out-of-Pocket Contribution: Assuming you qualify, you can contribute to your self-directed IRA from your personal checking or savings account, or with a credit card payment. This funding method is subject to annual maximum contribution limits set by the IRS each year. See the current contribution limits.

Frequently Asked Questions

What are some potential benefits of self-directed IRAs?

Depending on your situation, self-directed IRAs may be a great way to save for retirement. Here are a few of the potential benefits:

- Nearly unlimited investment options: including private market alternative investments

- You’re in the driver’s seat: self-directed IRAs allow you to invest in assets you know best

- Keep more of what you earn: An Equity Trust account provides you with the opportunity for tax-free or tax-deferred growth

- Leave a legacy: Allow named beneficiaries to inherit the account’s assets after the account owner’s passing

Can I set up a self-directed IRA myself?

It’s easy to set up a self-directed IRA yourself at Equity Trust. You can start the account open process online here. If you need help along the way, our dedicated support team is available at 888-382-4727.

How do self-directed IRAs work?

The term “self-directed” means you’re in the driver’s seat. Several types of retirement and savings accounts can be self-directed, including Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, Solo 401(k)s, Health Savings Accounts, and Coverdell Education Savings Accounts. When you open one of these accounts with a directed custodian such as Equity Trust, your investment options are expanded to nearly anything you can think of. There may be certain exclusions from the IRS or your chosen custodian.

You are responsible for finding an investment for your self-directed account. Once you identify your investment, you direct your account custodian to process the investment by providing any required documentation and funding instructions. Any profits flow back into your account, tax-free or tax-deferred.

Can I invest in real estate with a self-directed IRA?

Provided you follow IRS guidelines, you can absolutely invest in real estate in a self-directed IRA. Real estate can be held in an IRA in several forms – here are a few:

- Single-family home: rental property, buy-and-hold, or rehab

- Vacation rental property

- Mobile home

- Turnkey real estate

- Developed land

- Undeveloped/raw land

- Commercial property

- Apartment building

- Farmland

- Much more

What is an IRA LLC?

An IRA LLC is the term for when an investor forms a business structure known as a Limited Liability Company to be owned 100 percent by the IRA, or potentially partnering multiple IRAs to form the LLC. Note that “LLC IRA” is just an industry term, similar to “self-directed IRA”. It is not a special type of entity structure, but rather denotes that the LLC is owned by an IRA or IRAs.

Why isn’t Equity Trust listed on the IRS non-bank custodian list?

All IRAs must be held by a custodial entity such as a bank, credit union, trust company, or an entity that is licensed and regulated by the IRS as a “non-bank custodian.”

The IRS website publishes a list of nonbank custodians. However, this IRS resource is not a complete list of every custodian. The IRS list does not include entities that qualify as an IRA custodian under state law, which includes Equity Trust.

Equity Trust is an IRS-approved custodian and a regulated South Dakota trust company. See the list of South Dakota chartered trust companies here.

Can I move my 401(k) into a self-directed IRA?

Yes, you can move 401(k) funds into a self-directed IRA through a rollover, as long as the funds are going into the same tax environment (for example, traditional 401(k) into a traditional IRA. Taxes and penalties may not apply if the distributed funds are deposited into a like account within 60 days from the date of distribution. Learn more here.