Investment Advisors & Financial Planners

Help Your Clients Diversify their Retirement Portfolios

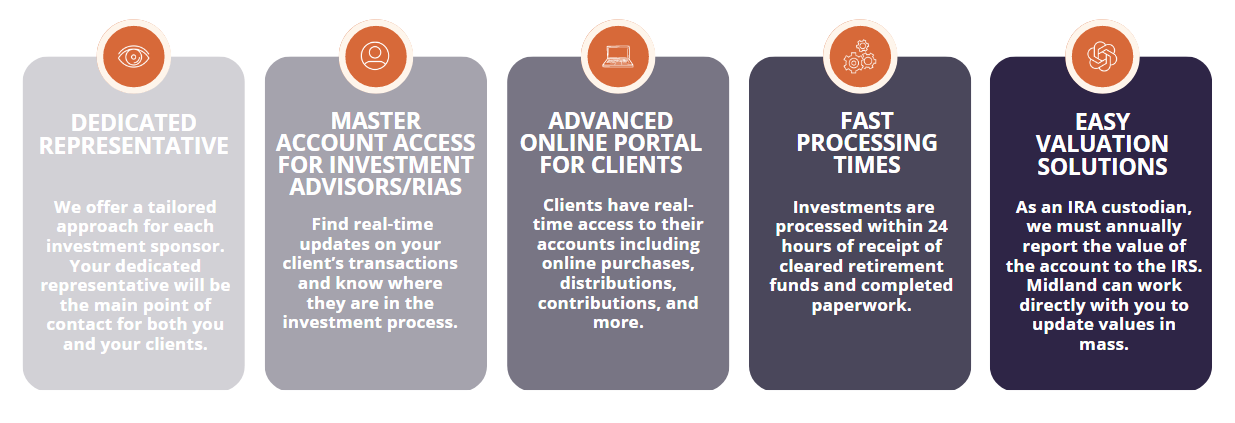

Service You Can Trust

Investment advisors and financial planners are turning to alternative assets to help clients truly diversify their retirement portfolios. Individuals who want a hands-on approach to growing their retirement enjoy the advantages of using self directed accounts.

Retirement accounts at Equity Institutional Services hold a large range of alternative assets. These include real estate, notes, hedge funds, and private equity offerings.

Equity Institutional Services is adept at streamlining the process for portfolio diversification. We provide exceptional services to investment advisors, financial planners, and investors. Clients and/or their advisors choose the alternative investments for the self directed account.

Why Equity Institutional Services?

Non-IRA Clients Invested in Alternative Assets

Equity Institutional Services offers custodial account options to serve those clients’ needs. A custodial account is an investment account for taxable money. This money can include personal savings, corporate savings, or trust funds. Custodial accounts allow investors to buy and sell alternative investments not traditionally offered by other custodians.

Benefits of Custodial Accounts for Investment Advisors & Financial Planners

- There is only one account to which dividends can be easily directed.

- Equity Trust allows investments to be housed under one umbrella as clients can have an IRA and a taxable account with Equity Trust.

- With accounts held under one umbrella, you have easy fee calculation and advisory fee payments using cash within the account.

- Equity Trust provides one statement with details for all assets held within an account and one contact regarding account funds.

Benefits of Custodial Accounts for Your Clients

- Acts as a home for your taxable money to efficiently allocate to alternative investments.

- Provides the tools to bring your investment online and process paperwork electronically.

- Allows for flexibility and tax diversification.

- Manages cash.

- Generates a historical database of all account activity and investment performance.

- Safekeeps investment documents.

- Prevents annual limits for how much individuals can save.

- Prevents IRS withdrawal restrictions or early distribution penalties for withdrawing before age 59½.

- Withdrawals are only taxed on the gains of the investments rather than the entire withdrawal amount (like Traditional IRAs or nonqualified withdrawals from Roth IRAs). Long term gains on taxable accounts are taxed at a rate of 15%.

- Joint accounts have rights of survivorship (JTWROS). This grants ownership of the account assets to the surviving individuals when a joint account holder passes.

Types of Alternative Investments

Equity Trust allows all types of alternative investments, including:

Types of Taxable Accounts We Offer:

- Individual

- Trust

- Joint

- Joint Tenants with Rights of Survivorship: All account owned assets are transferred from the deceased account holder to the surviving account holder.

- Tenants in Common: Account owned assets are transferred to the deceased account holder’s designated beneficiary(ies).

- Tenants by Entirety: Only in allowable states. Any change in ownership of assets of one account holder requires the consent of both account holders. All account owned assets are transferred from the deceased account holder to the surviving account holder.

%20Steps%20Infographic%20No%20Background.png)