50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

A promissory note is a loan, with a signed “promise” to repay the loan amount by a certain date, typically with interest added. Think of it like a loan from a bank – but with private lending, you’re the bank. Talk to an IRA Counselor about the range of note investing possibilities for your IRA, including:

Interested in real estate investing, but don’t want to be a landlord? Know of a local business in need of a boost? Promissory note investing – or private money lending – gives you the opportunity to loan funds from your IRA or other account to real estate investors, business owners, or others, providing you with a stream of passive, predictable, tax-advantaged income.

It’s not uncommon for investors to receive a 10 percent or more interest rate on a promissory note investment

Invest in real estate without the added work of managing a property: there’s little to do other than watch your payments flow in

Hedge against the traditional market with an alternative investment that’s not tied to stock performance

Loaning from a qualified retirement account shields you from taxes on your interest

You are the bank, so you set the terms, including interest rate and repayment schedule, for predictable returns

Help a struggling business, fund a promising startup, or contribute to a neighborhood housing revitalization, for example

Wondering how fast you can grow your account with private money lending? An overwhelming majority of Equity Trust clients investing real estate notes receive 10-percent or more profits back into their retirement account.

| Interest Rates | Percentage of All Notes Secured by Real Estate |

|---|---|

| Under 3% | 2% |

| 3% – 5% | 2% |

| 5% – 7% | 6% |

| 7% – 10% | 23% |

| 10% + | 67% |

Equity Trust enables you to loan money from your self-directed retirement account, tax-deferred or tax-free. Here’s what you need to know to reap the benefits of private lending in your retirement account:

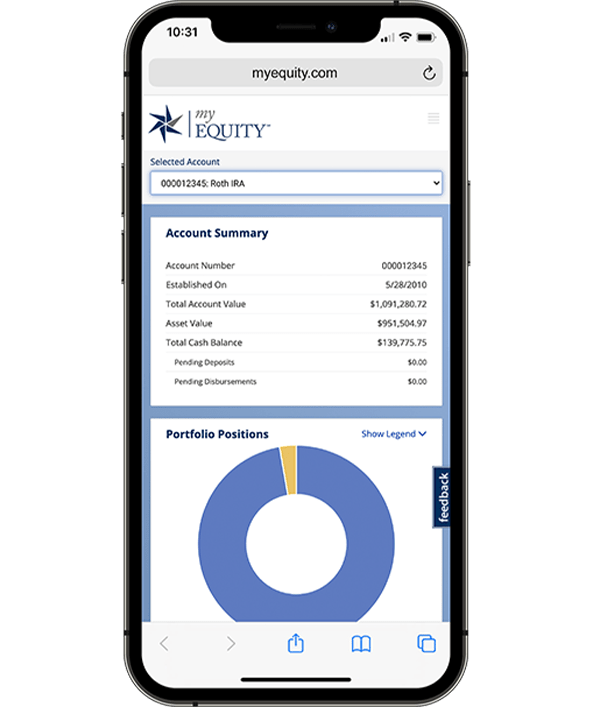

Easily invest in promissory notes and countless other assets online with myEQUITY, our state-of-the-art online account management system. Our technology enables you to:

What are you investing for? Whether your “why” is retirement, healthcare expenses, or a loved one’s education, we make the journey easy with innovated technology and first-class service.

Let our industry-leading education and resources help you navigate through your private money lending journey.

Learn how it works, promissory note investing rules, a real–life example, and how to get started.

Browse the tax-advantaged accounts and find one that matches your savings and goals- from retirement to education to health care savings.

Dig deeper into how note investing works in a retirement account.

Ready to Get Started?

Our knowledgeable IRA Counselors can answer your questions about the self-directed investing process and share insight and education about our self-directed accounts to help you decide what options may be best for you.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855-233-4382. Reply STOP to opt out from text messages. Message and data rates may apply. View Terms & Privacy.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue