50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Real estate investments can come in many forms, making it easy to find one that fits your interests. Talk to an IRA Counselor about the broad range of real estate assets that can be held in an IRA or other retirement account. Self-directed IRA real estate investments can include:

Real estate can be a profitable, rewarding way to grow your self-directed account and potentially help you achieve your dreams faster.

Real estate has historically generated higher returns than traditional/public market investments

Hedge against public investments with an investment not tied to stock market performance

Turn your expertise or a passion for real estate into revenue for your retirement account

Our clients’ accounts fund neighborhood revitalization and provide affordable housing

Many projects create jobs for local contractors and other service providers

From managing rehabs to lending money to real estate investors, there’s a variety of investment options

Equity Trust enables you to easily invest in real estate using your self-directed IRA or other account, tax-deferred or tax-free.

Here’s what you need to know to reap the benefits of this powerful investment type in your self-directed account:

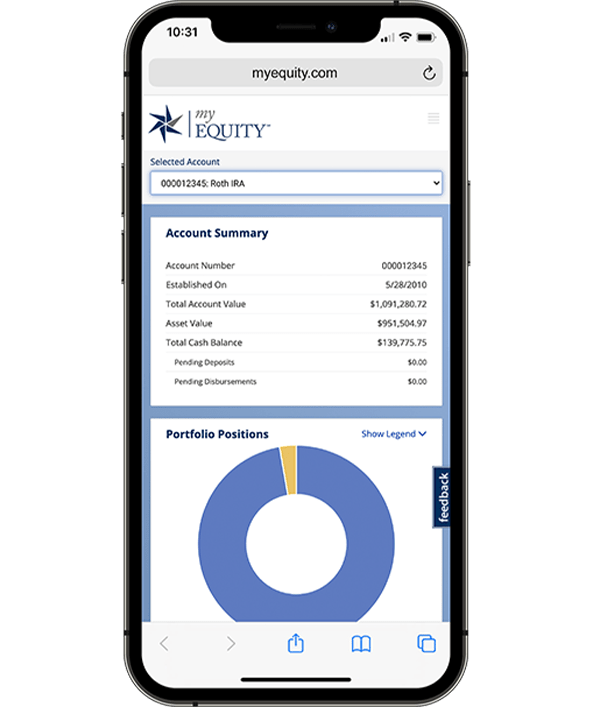

Buying real estate with an IRA has never been faster, easier, or more streamlined. Our state-of-the-art online account management system enables you to:

What are you investing for? Whether your “why” is retirement, healthcare expenses, or a loved one’s education, we make the journey easy with innovative technology and first-class service.

We don’t stop at providing a superior investing experience: Each client receives access to exclusive opportunities not found with any other self-directed account custodian. You’ll receive valuable, in-demand discounts and membership access – just for opening an account.

Let our industry-leading education and resources help you navigate through your real estate investing journey.

Learn how it works, read a real-life example, and how to get started.

Browse the tax-advantaged accounts and find one that matches your savings goals – from retirement to education to health care savings.

Dig deeper into how real estate investing works in a self-directed account.

Ready to Get Started?

Our knowledgeable IRA Counselors can answer your questions about the self-directed investing process and share insight and education about our self-directed accounts to help you decide what options may be best for you.

By entering your information and clicking Start a Conversation, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. This consent is not required to obtain products and services. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855-233-4382. Reply STOP to opt out from text messages. Message and data rates may apply. View Terms & Privacy.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue